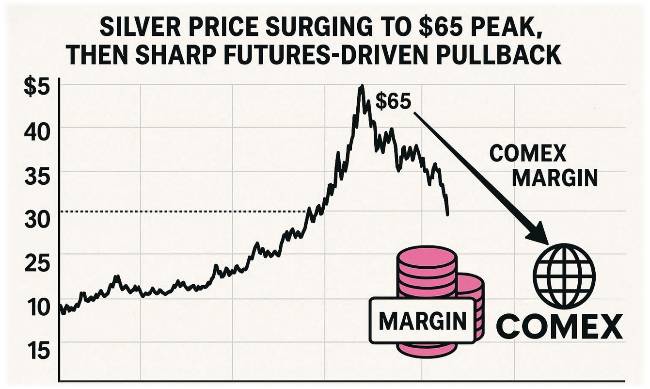

Silver Hits $65 High, Futures Margin Triggers Retreat

Disclaimer: This article provides factual information and market analysis for educational purposes only. It does not constitute investment advice, financial recommendations, or endorsements of any strategy. Precious metals markets involve risks; consult qualified financial professionals before making decisions.

By Doug Young – 14 December 2025

Introduction

Silver prices reached a nominal all-time high near $65 per ounce last Friday (December12) before pulling back sharply due to CME Group’s adjustments to COMEX silver futures margins.

The retreat involved over 67 million ounces in paper contracts traded within minutes, resulting from elevated performance bond requirements rather than shifts in physical supply.

Year-to-date, silver has climbed more than 100 percent, propelled by robust industrial demand and macroeconomic pressures.

Price Movement Timeline

Weekly Surge

Silver advanced from the high $50s to a peak of $64.66 by December 12, supported by Federal Reserve rate cuts and persistent supply constraints.

Spot prices closed at $62.01 on December 12, reflecting a 2.41 percent daily decline but an 18.56 percent monthly gain.

Friday Pullback Details

The CME raised margin requirements for front-month silver futures contracts, such as December 2025 and January 2026, increasing collateral demands on 5,000-ounce contracts.

This adjustment prompted traders to unwind leveraged positions, with 13,430 contracts—equivalent to 67.15 million ounces—sold in just 15 minutes.

Historical Context

When adjusted for inflation, current prices remain below 2011 peaks of approximately $70 to $72 per ounce, according to CPI calculations.

Starting from around $31 per ounce on January 1, 2025, the metal has more than doubled in nominal terms.

Margin Mechanics Explained

How Futures Margins Work

Margins function as good-faith deposits to cover daily price fluctuations, representing only a fraction of the full contract value.

Exchanges like the CME raise these requirements during periods of heightened volatility to mitigate risk, compelling traders to post additional funds or reduce holdings.

Impact on Spot Prices

Futures trading on COMEX influences spot prices through arbitrage mechanisms, generating short-term swings without involving physical delivery.

The recent volume surge highlighted leveraged position liquidations rather than any influx of actual silver into the market.

Fundamental Drivers

Supply-Demand Imbalance

Analysts project a 2025 market deficit exceeding 200 million ounces, as primary mining—much of it byproduct from other metals—struggles to match consumption.

Exchange inventories have declined amid this shortfall.

Industrial Demand Surge

Silver’s superior electrical conductivity drives its use in solar photovoltaic panels (requiring about 20 grams each), electric vehicles, and consumer electronics.

Renewable energy expansion positions industrial applications as a key growth factor through 2030.

Macro Influences

Persistent U.S. budget deficits and inflation erode dollar purchasing power, while accommodative Federal Reserve policies bolster precious metals.

Silver exhibits variable correlation with equities, often strengthening during economic uncertainty.

Market Implications

Paper vs. Physical Dynamics

COMEX futures introduce volatility to spot quotations, but physical market participants focus on dealer premiums and availability, which operate independently.

Recent events underscore the disconnect between derivative trading and tangible supply chains.

Broader Trends

Technical indicators like the Relative Strength Index showed overbought conditions prior to the pullback, suggesting potential consolidation.

Structural deficits continue to underpin long-term dynamics, barring major disruptions in demand.

Expert Perspectives

Analyst Views on Volatility

Market observers attribute the selloff to deleveraging rather than fundamental weakness, with physical tightness intact.

Reports emphasize solar and EV sectors as enduring demand drivers.

Educational Takeaways

Futures represent derivative instruments distinct from the cash market; resources like the World Silver Survey provide insights into supply fundamentals.

Margin adjustments illustrate how exchange rules shape price action alongside broader economic forces.

Disclaimer: This article provides factual information and market analysis for educational purposes only. It does not constitute investment advice, financial recommendations, or endorsements of any strategy. Precious metals markets involve risks; consult qualified financial professionals before making decisions.