At Gold IRA Companies Bulletin our goals are to:

1. Provide clear, evidence-based education to help you assess whether the inclusion of precious metals fits your retirement strategy.

2. Offer transparent, in-depth evaluations of Gold IRA companies, helping you identify reliable options.

3. Keep you informed with topical, accurate, news and developments regarding gold IRAs, precious metals markets, and retirement planning trends.

4. Empower you with dependable, thoroughly researched market knowledge to help you make confident, well-informed decisions about Gold IRAs.

IN-DEPTH ANALYSES OF GOLD IRA COMPANIES

GOLD IRA COMPANIES EVALUATION

GOLD IRA INFORMATION - EDITOR'S PICK

GOLD INVESTING INFORMATION - EDITOR'S PICK

LATEST GOLD NEWS

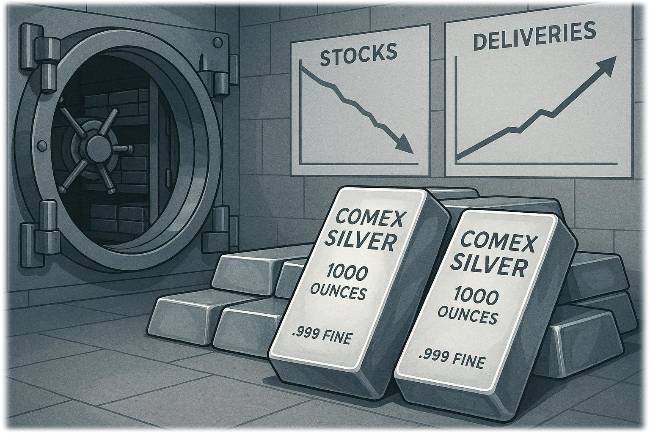

SILVER INVESTING INFORMATION - EDITOR'S PICK

LATEST SILVER NEWS

RETIREMENT PLANNING INFORMATION - EDITOR'S PICK

LATEST RETIREMENT PLANNING NEWS

LATEST WORLD FINANCIAL NEWS

MEET THE RESEARCHER

Doug Young Financial Markets Researcher & Former Financial Director

- Over 20 years of experience in financial markets

- More than 15 years specializing in Gold IRAs

- Extensive expertise in precious metals trading

- Former Financial Director at World Freight Services Ltd for 16 years.

- Author of 500+ published financial research articles over 10 years

- Conducted 80+ Gold IRA company evaluations since 2011

⚠️ IMPORTANT: All content on this website is for educational purposes only and should not be considered personalized financial advice. Always consult with a qualified financial advisor before making investment decisions.