Is COMEX Silver Heading for a Physical Crunch?

Disclaimer: This article provides educational information on silver market mechanics and is not investment advice. Past trends do not guarantee future results. Consult a qualified financial advisor before making any decisions.

By Doug Young – 14 February 2026

Introduction

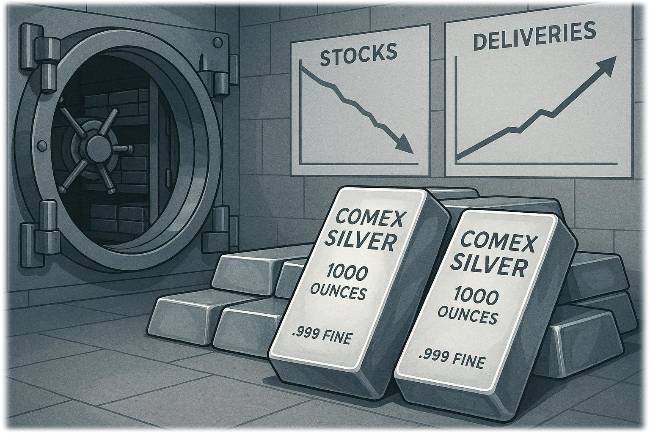

Recent surges in delivery notices on the COMEX silver futures market have sparked debate about potential strains in physical supply.

Traders and analysts are watching closely as registered inventories remain low ahead of the critical March delivery period.

COMEX, operated by CME Group, plays a pivotal role in establishing global silver benchmarks through its futures contracts, where physical delivery represents a small but telling fraction of total activity.

COMEX Silver Futures Basics

How Futures Contracts Function

Silver futures on COMEX are standardized agreements to buy or sell a specific quantity of metal at a predetermined price on a future date.

These contracts primarily serve hedgers, such as miners and industrial users, and speculators seeking price exposure.

Over 95% of contracts historically settle financially through offsetting trades or rollovers to later months, sidestepping physical exchange.

Eligible vs. Registered Inventory

COMEX vaults classify silver into eligible and registered categories.

Eligible silver meets quality standards for storage but remains under owner control, unavailable for immediate delivery.

Registered silver, by contrast, stands ready to fulfill contract obligations, forming the exchange’s core delivery buffer.

Declines in registered stocks amplify market sensitivity when delivery demands rise unexpectedly.

Recent Delivery Trends

Elevated Activity in Early 2026

Delivery volumes in 2025 outpaced 2024 levels across several months, with February 2026 showing unusually robust participation for a minor delivery cycle. This activity exceeded expectations relative to prevailing open interest, the total outstanding contracts.

March, a primary delivery month, now looms as a key test, with first notice day requiring longs to declare intent to stand for metal.

Metrics to Monitor

Key indicators include the ratio of open interest to registered stocks, weekly delivery notice filings, and comparisons to norms where just 1-5% of contracts typically result in delivery.

Elevated notices signal a shift toward physical settlement, prompting scrutiny of exchange capacity.

Inventory and Supply Dynamics

Thinning Registered Stocks

Registered inventories have trended lower, heightening dependence on participant behavior.

Eligible silver can convert to registered status when prices incentivize owners to commit bars, a process driven by market economics.

Persistent industrial fabrication and investor buying further compete for available physical supply outside exchange vaults.

Broader Supply Chain Pressures

Regional disparities, particularly in Asia, hinder seamless arbitrage due to shipping constraints and regulatory hurdles.

Physical premiums over spot prices have held firm despite recent corrections, underscoring tightness.

Silver’s split identity—serving solar panels, electronics, and as a store of value—sustains structural demand amid global supply chain focus.

Inventory Type Purpose Impact of Decline Eligible Owned storage, optional for delivery Limits quick conversions if owners hold back Registered Immediate delivery buffer Increases reliance on price signals for restocking Exchange Management Tools

Standard Responses to Stress

COMEX employs margin hikes to temper leverage, position limits on concentrated holdings, and promotion of exchange-for-physical (EFP) deals for cash settlements.

These tools maintain clearinghouse integrity without mandating additional metal inflows.

Extreme Scenario Safeguards

Force majeure declarations remain a remote threshold, requiring depleted registered stocks, uncooperative eligible conversions, and failed private sourcing by clearing firms.

Prior steps include incentive tweaks and negotiated resolutions. History shows exchanges prioritize pricing adjustments over operational halts, potentially widening futures-physical spreads.

Physical vs. Paper Market Realities

Delivery Process Mechanics

Standing for delivery involves issuing notices, random assignment to shorts, and warrant transfers for 5,000-troy-ounce contract units.

Buyers may load out bars from vaults in New York, Delaware, or other approved sites, though logistics add complexity.

Low delivery rates preserve liquidity but expose mechanics under duress.

Global Context

COMEX prices influence LBMA forwards and refinery outputs worldwide.

Geopolitical emphasis on critical minerals elevates silver’s profile, while high open interest relative to vaulted metal reflects a rollover-dependent system akin to fractional reserves in banking.

Key Metrics for Observation

Market participants track weekly COMEX inventory reports, March cycle delivery notices, spot-premium spreads, and silver lease rates as borrowing cost proxies.

These data points reveal alignment—or divergence—between paper trading and physical availability.

Educational Takeaways

Futures markets like COMEX anchor price discovery, yet physical dynamics govern true access costs.

Current trends illustrate self-correcting mechanisms via supply incentives, not inherent fragility.

Distinguishing paper positions from tangible possession remains essential for grasping commodity market nuances.

Disclaimer: This article provides educational information on silver market mechanics and is not investment advice. Past trends do not guarantee future results. Consult a qualified financial advisor before making any decisions.